When you look at the global gambling map, New Zealand stands out as a fascinating anomaly. It is a market where the rules seem contradictory at first glance, yet they create a specific channel of opportunity and risk for capital allocators. You might expect a developed nation to have a tightly ring-fenced digital gambling ecosystem, similar to the United Kingdom or parts of the United States. Instead, what I have observed in New Zealand is a system that effectively bans local competition while leaving the front door wide open for international operators.

For an investor or business leader, this creates a unique dynamic. You are not looking at a market driven by domestic startups fighting for market share under a local regulator’s watchful eye. You are looking at an export economy of sorts, where Kiwi dollars flow outward to offshore entities. Understanding this flow, and the specific dominance of online slot machines, or “pokies” as they are locally known, is critical if you want to gauge the long-term viability of this sector. The legal framework here is not just a set of rules: it is the defining market force that currently shapes every transaction, every profit margin, and every strategic entry point.

Key Takeaways

- The Gambling Act 2003 bans domestic operators but allows offshore online casinos in New Zealand to legally serve local players.

- Digital pokies drive the majority of sector revenue due to high play velocity, predictable margins, and a cultural shift toward mobile gaming.

- New Zealand currently operates as a ‘grey market,’ resulting in significant tax leakage that will likely force a shift to a regulated licensing model.

- Investors should prioritize international operators with strong compliance structures that are prepared for future regulatory changes.

- Although playing is legal, transaction friction remains a risk as banks often block payments to offshore gambling entities.

Understanding the New Zealand Gambling Act 2003

To really grasp the investment potential here, you have to strip away the assumptions you might hold from other jurisdictions. The Gambling Act 2003 is the piece of legislation that governs everything, and it is built on a philosophy of prohibition rather than permission. Unlike markets where the law describes how to get a license, this law primarily describes why you cannot have one. In my analysis of the Act, I see a clear intent to limit gambling growth, yet the drafting from two decades ago did not fully anticipate the borderless nature of the modern internet.

The Prohibition on Domestic Remote Interactive Gambling

If you were thinking of setting up a server in Auckland and launching a digital casino platform, the law stops you cold. The Act explicitly prohibits “remote interactive gambling” for domestic operators. This means no New Zealand-based company can legally offer online casino games, including pokies, to New Zealand residents. The intent was to protect the community by preventing gambling from becoming too accessible in people’s homes.

From a business perspective, this creates a complete barrier to entry for local firms. There is no grey area here for a domestic startup: it is simply illegal. This protectionist stance, ironically, does not protect the market from the product itself, but rather shields offshore competitors from local rivalry. You effectively have a market where local innovation is stifled by statute, leaving a vacuum that demands to be filled.

The Offshore Exemption for International Operators

Here is where the situation gets interesting for global investors. The Act prohibits the offering of remote gambling in New Zealand, but it does not explicitly criminalize the act of a New Zealander playing on a site hosted outside New Zealand. Section 9 of the Act is often cited in legal opinions I have reviewed. It essentially says that the prohibition applies to the remote interactive gambling provider, not the player.

Because the New Zealand government has limited jurisdiction to prosecute companies based in Malta, Gibraltar, or the Isle of Man, these operators serve Kiwi customers with impunity. It is legally permissible for a New Zealander to log on to an offshore site and play real-money pokies. This loophole, or perhaps more accurately, this jurisdictional gap, is the foundation of the entire current market. It turns New Zealand into a free-for-all for international brands, who can acquire high-value customers without paying local gaming taxes or adhering to local harm minimization standards.

The Dominance of Pokies in the Digital Economy

When you dissect the revenue streams of any major gambling operation, slot machines almost always do the heavy lifting. In New Zealand, the cultural affinity for “pokies” makes this even more pronounced. Walk into any local pub in the country, and you see physical machines. That behavior has translated directly to the digital screen. I have looked at the numbers, and the migration from physical venues to online platforms is not just a trend: it is a fundamental shift in consumer spending.

Why Slots Drive High Revenue Margins

For the investor, the appeal of online pokies lies in their operational efficiency. Unlike sports betting, which requires complex risk management teams and fluctuates with match results, slots are purely mathematical engines. They offer a fixed Return to Player (RTP) percentage, ensuring a predictable hold for the operator over the long term. You do not need a trading floor to manage a slot portfolio.

Besides, the speed of play on digital slots is significantly higher than in physical venues. A player on a smartphone can spin the reels every three seconds without the friction of inserting coins or waiting for a machine. This velocity of capital turnover is what drives the exceptional margins we see in this vertical. When you combine this with the lack of local tax duties for offshore operators, the net retention from a New Zealand player is often higher than that from a player in a regulated market like the UK or Sweden.

Consumer Behavior and the Transition to Online Play

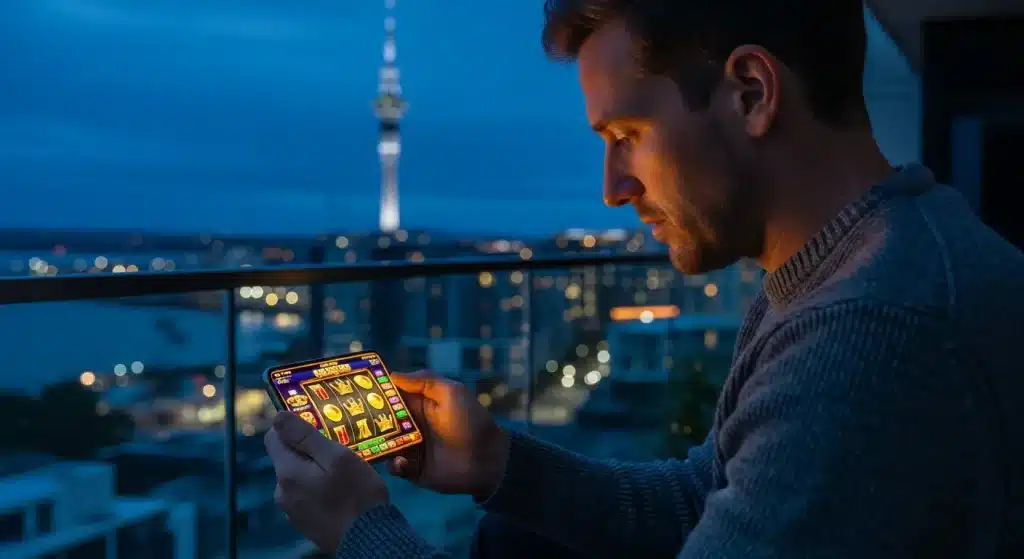

You also need to watch the demographic shift. The traditional pokie player in a brick-and-mortar club is aging. The new wave of value comes from younger demographics who view gambling as a mobile-first activity. I have observed that convenience is the primary driver here. The ability to play a few spins during a commute or on the couch replaces the intentional trip to a gaming venue.

This transition effectively decouples gambling from a social outing, turning it into a private, on-demand entertainment product. For an international operator, this means the addressable market is not limited by physical geography or venue operating hours. The device in the user’s pocket is the casino, open 24/7. This accessibility is why the digital pokies sector continues to expand even when physical gaming revenue stagnates.

Financial Implications of the Grey Market

The term “grey market” often worries institutional investors because it implies instability. In New Zealand, but, the grey market has been the status quo for years. The financial implications are stark, particularly when you look at where the money ends up. It creates a capital flight scenario where millions of dollars leave the domestic economy annually, benefiting offshore shareholders rather than the local treasury.

Tax Revenue Leakage and Fiscal Policy

If you were the Finance Minister, you would look at the estimated hundreds of millions flowing out of the country and see a massive hole in the tax net. Offshore casinos generally pay zero gaming duty to the New Zealand government. They might pay GST (Goods and Services Tax) on digital services if they are compliant with those specific rules, but they avoid the heavy levies and community contributions required of local land-based operators.

This leakage is a double-edged sword for you as an investor. On one hand, it boosts the profitability of the offshore companies you might be analyzing. On the other hand, it makes the current situation politically unsustainable. Governments rarely ignore lost revenue forever. You should factor in the high probability that fiscal pressure will eventually force a change in the law to capture some of this value, which would impact operator margins.

Compliance Challenges for Cross-Border Payments

Moving money in and out of a grey market is never straightforward. While it is legal for players to gamble, banks and payment processors often view these transactions as high-risk. I have seen instances where transactions are declined not because of a legal ban, but because of internal bank risk policies. This friction costs money.

Operators have to rely on third-party payment gateways and e-wallets to ensure smooth deposits and withdrawals. These intermediaries charge fees, eating into the net revenue. Besides, Anti-Money Laundering (AML) compliance becomes a headache when you are dealing with cross-border flows without a local license to validate the source of funds. You need to assess whether an operator has resilient payment rails, because if the money cannot move, the business stops.

Future Regulatory Outlook for Investors

The most critical question for your long-term strategy is: how long will this last? The status quo is comfortable for operators right now, but regulatory winds are shifting. New Zealand regulators have been watching global trends, and there is a growing consensus that the 2003 Act is no longer fit for purpose in a digital world.

Potential Shifts Toward a Licensing Model

The Department of Internal Affairs has previously released discussion documents suggesting a move toward a licensing framework. This would likely involve allowing operators to apply for a license to serve New Zealanders legally, in exchange for paying taxes and adhering to harm minimization rules. For you, this would mean a market reset. The “Wild West” days would end, replaced by a consolidated market where only the largest, most compliant operators survive.

If a licensing model is adopted, you can expect a consolidation phase. Smaller, fly-by-night operators who cannot afford compliance costs will exit, leaving more market share for major listed gaming companies. This transition usually presents a prime investment opportunity in the well-capitalized firms that are ready to pivot from grey to white market operations.

Comparing New Zealand to Regulated Global Jurisdictions

When I compare New Zealand to places like Australia or the UK, the path forward seems clear. Australia strictly banned online casino games (allowing only sports betting), while the UK embraced and taxed them. New Zealand seems more likely to follow a path similar to the UK or Ontario, Canada, eventually. Prohibition has failed to stop the demand, so regulation is the logical next step.

In regulated jurisdictions, valuations for gaming companies tend to stabilize. The risk premium associated with grey market operations evaporates, often leading to multiple expansion for the stocks involved. If you position your portfolio before this regulatory shift occurs, you stand to benefit from the legitimization of the sector.

Risks and Ethical Considerations in the Gambling Sector

You cannot evaluate this sector purely on spreadsheets. The human cost of gambling is a real liability that translates into financial risk. New Zealand has a strong focus on public health, and problem gambling is treated as a serious social issue. The current offshore model draws criticism because international sites often lack the “circuit breaker” mechanisms mandated for local venues.

From an Environmental, Social, and Governance (ESG) perspective, this sector is challenging. Institutional funds often screen out gambling stocks, which can depress valuations. Besides, if the government decides to crack down, it will likely be driven by stories of harm and addiction. I have seen regulations tighten overnight in other markets following media scandals involving vulnerable players.

Your risk assessment must include the possibility of strict advertising bans or spending caps. If New Zealand regulates, it will likely impose tight limits on how much a player can lose, similar to the UK’s affordability checks. This would directly impact the high-volume revenue from “VIP” players, who often drive a disproportionate share of profits. Ignoring the ethical dimension is a strategic error because in this industry, social license to operate is just as important as the legal one.

Conclusion

The New Zealand online pokies market currently sits in a lucrative but precarious position. You have a legal framework that unintentionally favors offshore capital, a consumer base that has enthusiastically adopted mobile play, and a government that is slowly realizing it is missing out on substantial revenue. For the astute investor, the opportunity lies not just in the current cash flows, but in anticipating the inevitable regulatory correction.

I believe the smart money is watching the major international operators who are already treating New Zealand as a de facto regulated market, paying GST, implementing responsible gaming tools, and building a brand reputation that will survive a legislative overhaul. The grey market era is likely in its final chapters. Your move now should be to identify which entities are building sustainable moats based on product quality and compliance readiness, rather than those simply exploiting a temporary legal loophole.

Frequently Asked Questions about Online Casinos in New Zealand

Is it legal to play at online casinos in New Zealand?

Yes, it is legal for residents. While the Gambling Act 2003 prohibits domestic companies from operating remote interactive gambling servers within New Zealand, it does not penalize individual players for accessing online casinos hosted offshore. This jurisdictional gap allows Kiwis to legally play on international sites.

Why are online pokies considered the king of New Zealand casino games?

Pokies dominate the market due to cultural affinity and operational efficiency. They offer a fixed Return to Player (RTP) and high velocity of play, especially on mobile devices. This makes them the primary revenue driver—the “king” of the sector—surpassing sports betting in consistent profitability and user engagement.

Do I have to pay taxes on online gambling winnings in New Zealand?

Generally, no. In New Zealand, gambling winnings are regarded as prizes rather than taxable income for recreational players. You are not required to declare these winnings to the Inland Revenue Department unless you are a professional gambler whose primary source of income is betting.

Are there plans to regulate the New Zealand online gambling market?

Yes, regulatory shifts are expected. The government is reviewing the 2003 Act to address tax leakage and consumer protection. Future legislation will likely move toward a licensing model similar to the UK or Ontario, requiring offshore operators to pay local taxes and adhere to strict harm minimization standards.

How can I ensure an offshore casino is safe to use?

Since domestic licenses do not exist yet, you should verify that the operator holds a license from a reputable international jurisdiction, such as the Malta Gaming Authority (MGA) or the UK Gambling Commission. Also, look for secure payment gateways and visible responsible gambling tools to ensure a fair and safe experience.